Financial Advice

No matter the circumstances, with our expertise we are able to provide the right solutions, recommendations and strategies to ensure you feel secure and motivated.

Life Planning

We understand your why, your motivations and your ambitions. We create a bespoke life plan, outlining the best route to take in your financial journey to achieving your goals.

Financial Planning

We use statistical models to create a financial roadmap tailored to your goals, forecasting risk and growth expectations to develop the right financial plan.

Wealth Management

We encompass all parts of your financial life into a holistic approach, that interrelates all the services needed to manage your money and plan for your future.

THE TRADENOMIC

DIFFERENCE

Tradenomic Financial performs at the forefront of our industry. Our performance comes with our style of a sophisticated approach to investing and wealth building, by delivering exceptional value and client-centric solutions. We go beyond traditional advice firms.

- Goal-Oriented Planning for ROI Achievement

- Institutional Expertise for Sophistication

- Enhancing Wealth through the Power of Technology

- Dedication to Exceptional Tailored Client Service

COMPLETE HONESTY AND TRANSPARENCY

Our Vision and Values

Our vision is to empower individuals and families with institutional methods to achieve financial well-being. We value our clients’ needs, aspirations and financial goals, providing personalised solutions based on trust, integrity and transparency. We uphold the highest ethical standards, embrace innovation and leverage technology to enhance our services. We educate and empower our clients to enable them to feel confident in their financial future. Our unwavering commitment to excellence guides us in making a positive impact on our clients’ lives, helping them attain financial security and prosperity.

WHY CHOOSE US

Unlock Your Financial Potential

Whether you’re planning for retirement, investing for growth, or seeking comprehensive financial planning, we have the knowledge, tools and resources to help you make informed decisions and navigate the complexities of the financial landscape. Join us on this journey to financial prosperity and experience the difference of choosing Tradenomic Financial.

Institutional Methods

Our highly skilled financial advisers possess extensive industry experience and deep knowledge of financial markets.

Goals Based Plans

Gain clarity and focus on the roadmap and take the steps to make your perfect picture come to reality whilst knowing the potential risks to achieving growth.

Tangible Milestones

We outline measurable milestones from the planned framework and provide a sense of accomplishment along your financial journey.

Confidence and Peace of Mind

Our roadmap enables you to make financial decisions with greater conviction and stability.

Innovative Technology

Empowering greater control, convenience and access. Using cutting-edge tools to enhance services and deliver a more personalised experience.

Adaptability

We are proactive in making adjustments based on your dynamic life, evolved goals and market conditions to allow you to leap over any obstacle.

OUR PRINCIPLES

Giving You A Financial Edge

We offer a high quality, institutional based service that aims to meet the individual demands of today’s sophisticated investors and individuals seeking comprehensive financial solutions. We help guide our clients through the increasingly complex investment world.

Objectivity

We act as a fiduciary, ethically bound to act in the client’s best interest to create a long-lasting relationship.

Collaboration

We work closely with you to ensure every decision is made with your views, principles and goals in mind.

Performance

We implement a results-driven approach to deliver on our financial plans to achieve your goals.

SIX STEPS TO SUCCESS

We Help You Every Step Of The Way

1. Getting To Know You

Free discovery consultation to help us understand your goals and objectives

2. Confidential Review

Detailed meeting to define your holistic financial overview in order to carry out the research to develop your plan

3. Plan Design

We will present all solutions that would ensure protection and prosperity inline with your needs and goals

4. Implementation

Put the plan in action and implement the strategies we have created, keeping you informed of the progress to get you where you want to be

5. Optimisation

On-going reviews and performance analysis ensure you are on track. Our reviews will hep you to optimise funds based on updated projections

6. Stay On Course

The impact of behavioural biases can be costly, we apply methods to help you maintain the course using NLP techniques and regular communication

Methodology Matters

When it comes to financial success, the methodology we employ is of utmost importance. We apply a strategic and well-defined approach to unlocking your financial goals. Our method involves using quantitative and qualitative analysis of your unique circumstances and the financial landscape. We develop advanced strategies that align with your aspirations and risk tolerance. We monitor live market conditions to identify changes in market themes and respond effectively to global market conditions.

THE OLD WAY

The Old Process Can’t Keep Up

As the world rapidly evolves and client needs continue to shift, we recognise the importance of staying ahead of the curve. Our approach is designed to meet the dynamic demands of today’s markets, offering more frequent touchpoints and education along with a commitment to performance and accountability. By embracing modern practices, we ensure that our clients receive the highest level of service and support tailored to their evolving financial goals.

THE NEW WAY

Transformative Financial Advice Practice

We believe in the power of personalisation, tailoring our services through in-depth consultations and assessments. We develop institutional led strategies and sophisticated portfolios aligned to individual circumstances, risk tolerance and aspirations.

Technology

We leverage technology to enhance client experience and streamline processes. Our digital solutions give access to real-time updates, live financial information and interactive tools for financial planning and analysis

Institutional Methods

We apply advanced institutional methods to build a sophisticated financial plan that aims to protect to times of uncertainty and achieve growth using accountable performance metrics

Strategy Led Accountability

We take accountability for keeping you informed on market conditions and the performance of your portfolio inline with your roadmap. We run backtests and scenario analysis that determines milestones we aim to accomplish

ELEVATE YOUR RESULTS

The Power of Specialised Knowledge

Specialised knowledge holds immense power when it comes to making informed financial decisions. We possess deep knowledge and experience in specific areas such as investment strategies, retirement planning, tax optimisation and more. We harness the power of specialised knowledge to provide our clients with tailored solutions and valuable insights.

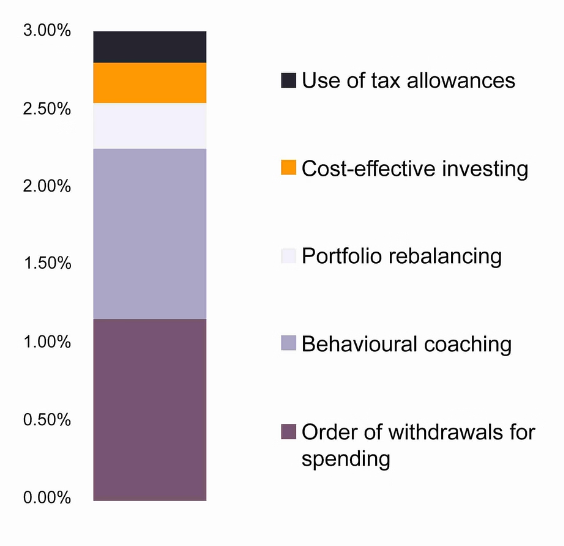

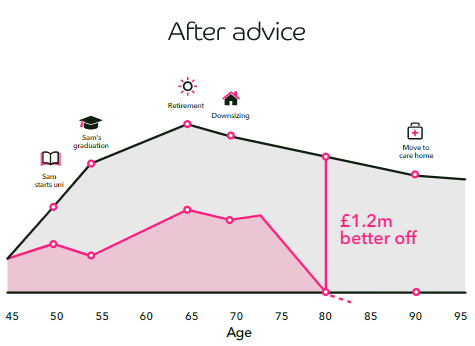

The Benefit of Financial Advice

A study highlighted the benefits of Financial Advice. In June 2020, Vanguard UK concluded that, on average, investors could potentially see a return that is approximately 3% higher compared to investors that do not receive advice.*

*Vanguard UK – Putting a value on your value Advisers Alpha in the UK – June 2020

Why do I need advice?

Financial advice ensures your money is working diligently to its full potential. By providing expert guidance, it allows you to focus on other aspects of your life with peace of mind.

Couldn’t I just do it myself?

The statistics speak for themselves: the majority of individuals without advisers struggle to meet their goals. Most individuals are unable to build and maintain a plan, not to mention keeping on top of changing rules and regulations which can all be a full-time job in itself.

Is it worth it?

The bottom line: individuals who take financial advice typically end up in a better position than those who do not. So, taking financial advice is a proven pathway to success.

Here are some of the partners we work with

What our clients say

As a business owner, I needed a financial adviser who could help me navigate the intricacies of managing my finances while growing my business. Tradenomic Financial exceeded my expectations. Their team understood the unique challenges I faced and provided tailored solutions to optimise my financial strategies. Thanks to their expertise, I feel more in control of my financial future.

I'm so thankful for the financial help I got from Gavin and his team at Tradenomic Financial. He really knows his stuff and gave me personalised advice that made a big difference in helping me structure my finances. With his support, I feel better informed and confident in my investment choice. I highly recommend Gavin for reliable and expert financial guidance.

I'm so grateful to Tradenomic Financial as I start my financial journey. As a young woman and focused on building my career, I needed guidance on saving and planning for the future. The team provided invaluable advice and I now feel secure with a financial plan in place. They are truly understanding and provided recommendations to things I would not have thought about. Thank you so much for a wonderful experience and I look forward to our next meeting.

Read more client feedback:

Get in Touch

Let us take the mystery out of finanical planning so you can focus on what matters.